Minimise risk. Be compliant.

We automate AML

We automate AML  compliance

compliance

Anti Money Laundering (AML)

Know Your Customer (KYC)

Counter Terrorism Financing (CTF)

Customer Due Dilligence (CDD)

Increase team efficiency

Automate KYC and CDD to improve efficiency

Be AML compliant

Simplify AML obligations and strengthen compliance

Peace of mind

All-in-one compliance solutions for total peace of mind

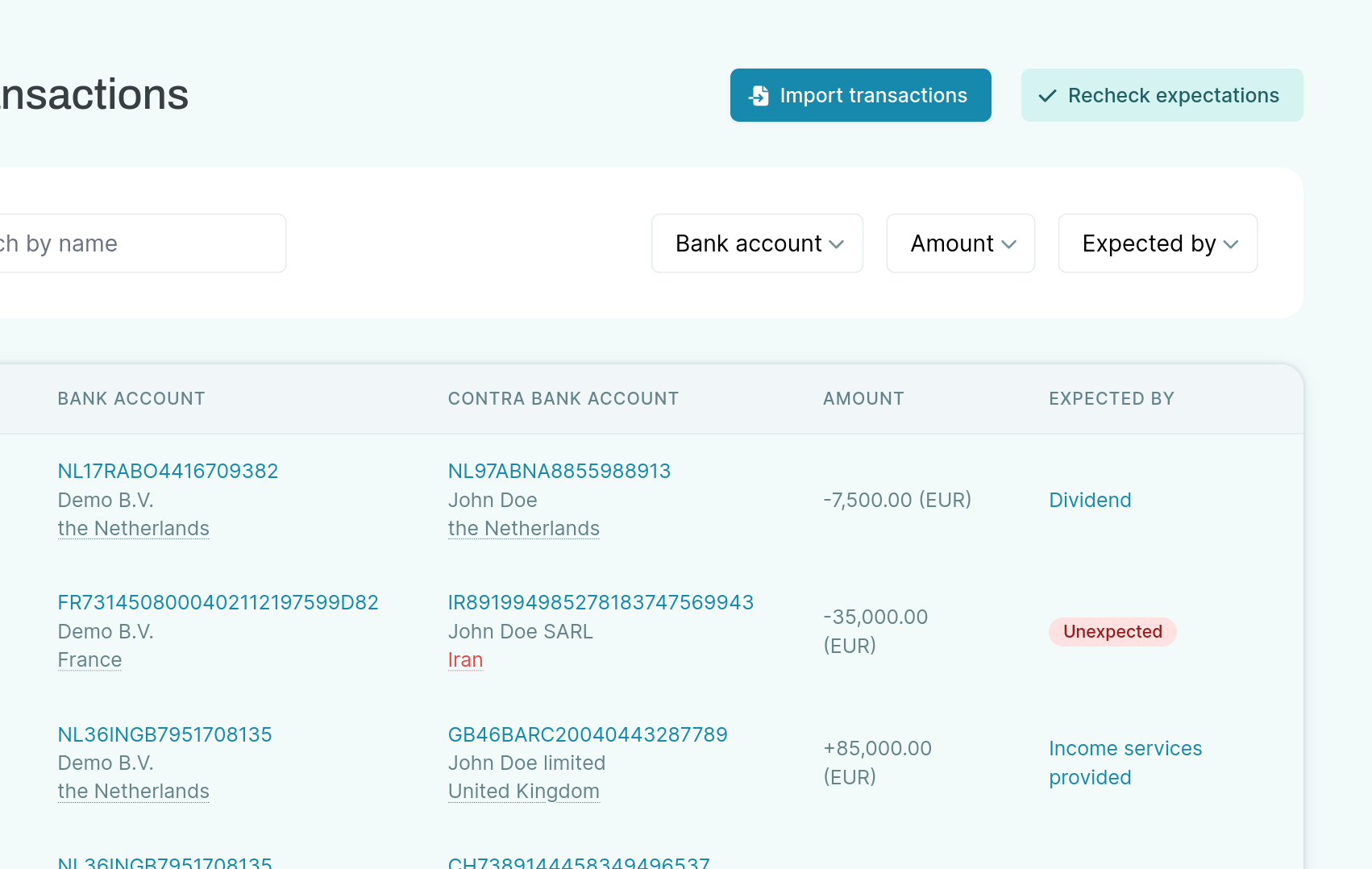

Transaction monitoring

Import transactions automatically and let our software do your work.

-

Real time bank connection to over 2200 banks for instant monitoring as transactions occur.

-

Import automatically via direct bank connection or upload CSV, MT940 or CAMT.053 statements.

-

Build transaction profiles tailored to your business rules for risk based monitoring.

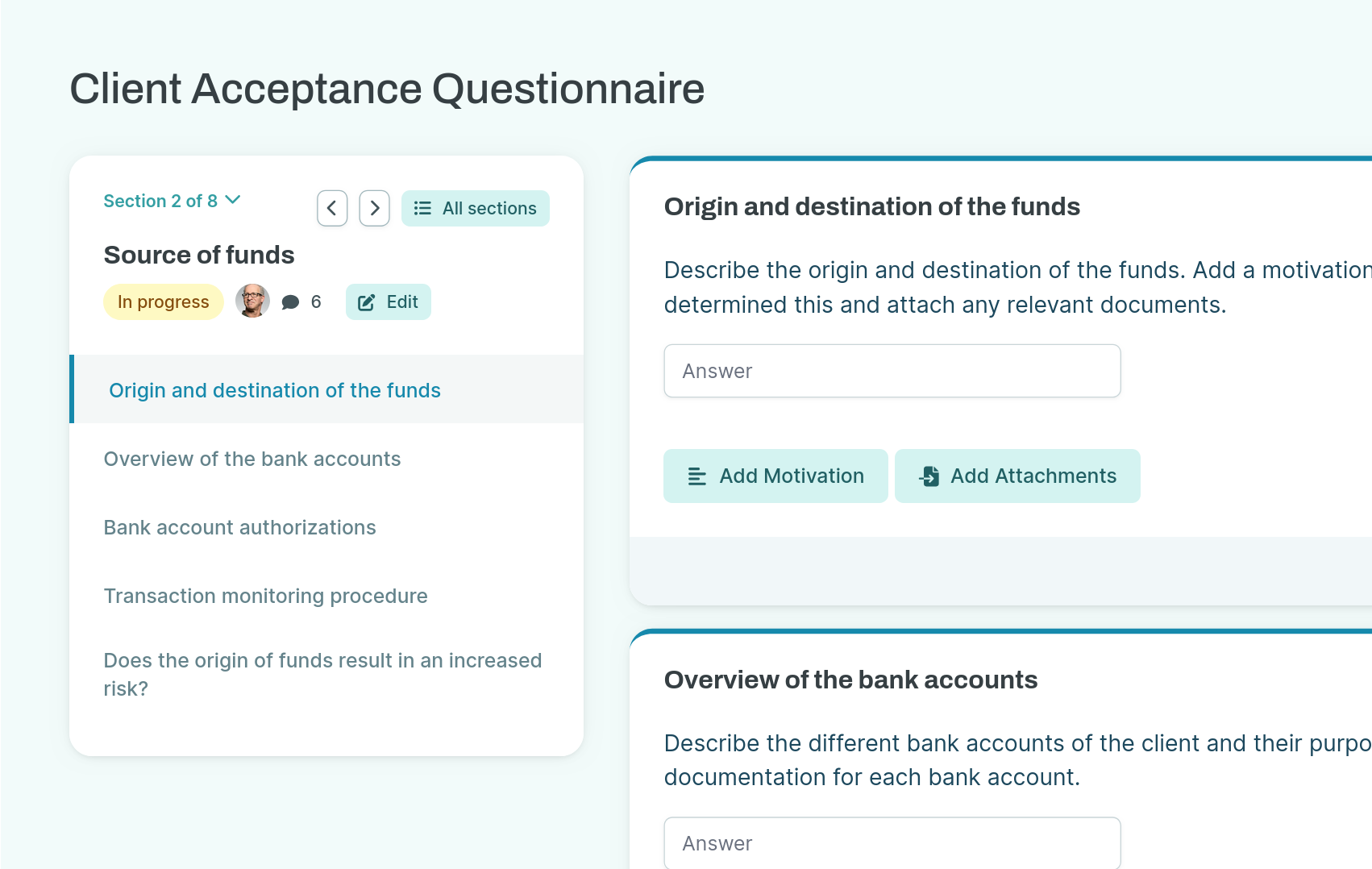

Client Acceptance

Centralise all compliance data in one platform for efficient and well informed onboarding decisions.

-

Generate a digital acceptance file, assess integrity risks and document compliance checks.

-

Clearly document structure purposes and automatically create structure charts.

-

Automatically generate an Acceptance Memorandum and track risk mitigation actions.

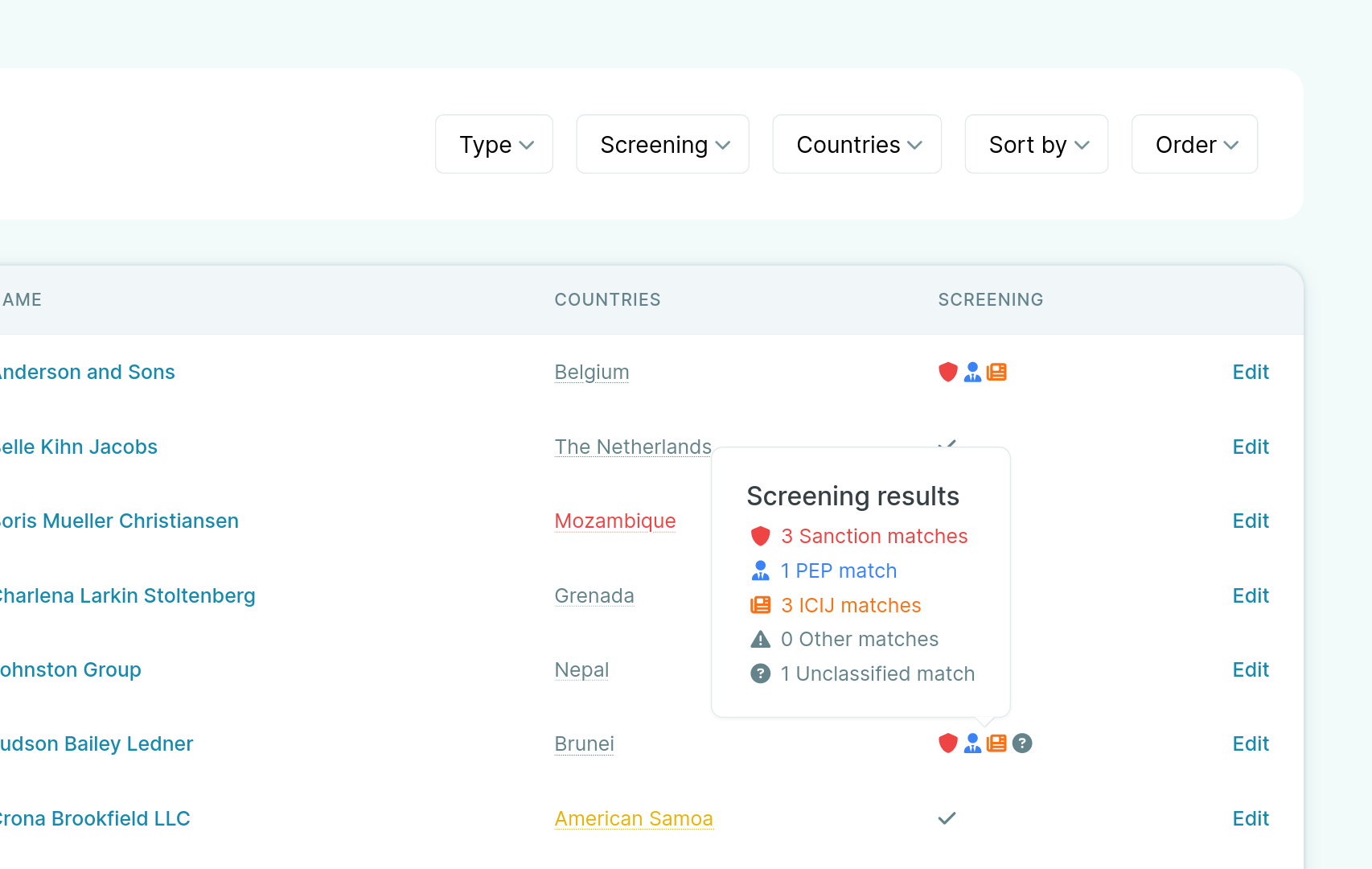

Sanction Screening

Screen against major sanctions and watchlists including PEP, ICIJ and OFAC.

-

Daily automated screening with instant alerts on new sanctions or watchlist matches.

-

Investigate and classify matches with direct links to official sources for due diligence.

-

Screen for sanctions and PEPs and view country risk indicators such as CPI scores, FATF status and non cooperative tax jurisdictions.

Our  solutions.

solutions.

Sanctions & Screening

Single screening

Ongoing screening

Sanctions, PEP, ICIJ checks

CPI scores, FATF lists, tax jurisdictions

Popular

Learn more →

Transaction monitoring

Up-to-date transaction profiles

2,200+ bank connections

CSV import

Plan and track transactions

Client Acceptance

Automated structure charts

Client acceptance files

Automated reporting

Complete audit trail